When you invest in HVAC equipment, you can write-off the investment on your taxes, and a commercial air conditioner is no exception. However, you may have heard that there are strict rules for doing so that are a bit more complicated than just writing down the total cost of your commercial air conditioner and keeping the receipt. HVAC equipment once needed to be depreciated, but not anymore.

When you invest in HVAC equipment, you can write-off the investment on your taxes, and a commercial air conditioner is no exception. However, you may have heard that there are strict rules for doing so that are a bit more complicated than just writing down the total cost of your commercial air conditioner and keeping the receipt. HVAC equipment once needed to be depreciated, but not anymore.

The tax laws for writing off your HVAC system changed in 2018 with code 179. If this is the first time that you’ll be writing off an air conditioner since then, it’s worthwhile to familiarize yourself with the rules. Here’s what you need to know about commercial air conditioner depreciation.

The New Tax Rules for HVAC Equipment

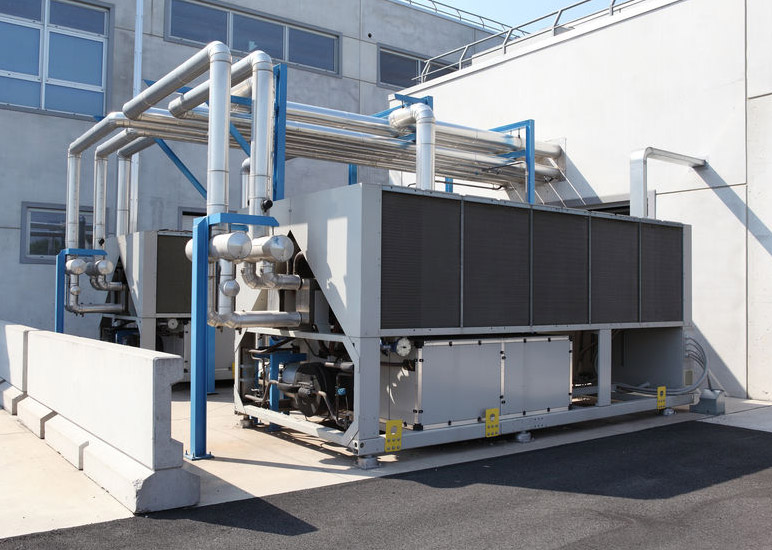

Starting on January 1, 2018, federal tax code 179 was changed. This new tax law allows businesses to deduct the total cost of their HVAC equipment in the same year that it comes into service. This means that if you buy a new commercial air conditioner in 2021, and it is up and running before the end of your tax year, then you can deduct the cost. There’s no more calculating depreciation or keeping track of the expense for 39 years.

The goal of this new change is both to incentivize businesses to invest in new, more energy-efficient HVAC equipment and to simplify the tax code. This change does apply to all commercial heating, ventilation and air-conditioning equipment.

This deduction is not just the cost of the equipment itself either. You can also write-off the cost of the labor. The total invoice that we give you should be deductible in tax, if you choose to use it. Of course, you should not expect to get the full investment value back in a tax break. It will all depend on your business’s specific tax situation.

The Benefits of Tax Code 179

What kind of benefits will your business experience as a result of this tax law change? Here are a few:

- Easier investment: Getting your tax deduction immediately can make it easier for you to afford investing in the equipment that you need.

- Better equipment: In fact, you may be able to invest in better equipment that uses less energy or better meets the needs of your customers because you’re getting your write-off in full right away.

- Simpler taxes: It’s always a good idea to simplify the work of your accountant and make it easier for you to understand your taxes.

What About Old Equipment?

Unfortunately, if you invested in HVAC equipment before 2018, you will have to keep following the old depreciation rules for this equipment on your taxes. Each year for 39 years, you get to deduct a portion of the overall investment that you made. But, at least this frustrating system is on it’s way out!

Are You Ready For New Commercial HVAC Equipment?

This tax code change is only the start of the benefits that your business can receive from new HVAC equipment. Reach out to us today to discuss your needs.